Apprenticeship Programs

The LiUNA Local 183 Training Centre is proud to have Training Delivery Agent status in the following four apprenticeship programs: Construction Craft Worker (LiUNA’s signature program), Brick and Stone Masonry, Cement Finishing, and Tractor Loader Backhoe. Each apprenticeship program provides the apprentice with comprehensive simulated real job site experience. With each of the programs, the apprentice will also receive all the necessary health and safety courses required to keep them safe on the job site. We offer different apprenticeship programs at each of our campuses. For a complete listing of our apprenticeship programs, see our program guide or course details online and for entry requirements please see the “How It Works” section on this page.

Our class hours are Monday to Friday 7:30 am to 3:00 pm.

*Please note that Members of LiUNA Local 183 receive priority for all programs.

**Applications should be submitted 6-8 weeks prior to the course start date.

There will be NO REFUNDS provided should you not attend, get removed, or drop out of a program!

Construction Craft Worker Level 1

The Construction Craft Worker (CCW) Apprenticeship is an extremely versatile program that offers the trainee the capacity to work in a variety of sectors and construction fields.

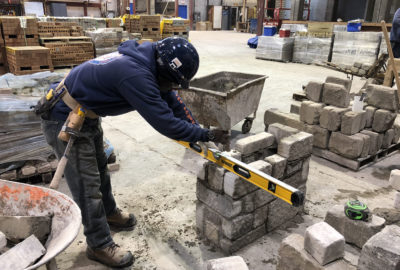

Brick and Stone Mason Level 1

A Brick and Stone Mason is also known as a Bricklayer. A Bricklayer specializes in preparing and laying brick, concrete blocks, stone and structural tiles and other masonry units. They are also trained to repair walls, partitions, patios, arches, paved surfaces, fireplaces and chimneys.

Cement (Concrete) Finisher Level 1

In our Cement Finisher Apprenticeship, trainees will learn how to place, finish and protect concrete surfaces. Cement Finishers work on a wide variety of vertical and horizontal surfaces and structures such as, concrete floors, wall, sidewalks, stairs, driveways, curbs, gutters, damns, bridges and tunnels.

Government Incentives

The Apprenticeship Incentive Grant (AIG) is a taxable cash grant of $1,000 per year, up to a maximum of $2,000 per person, available to registered apprentices once they have successfully finished their first or second year/level (or equivalent) of an apprenticeship program in one of the Red Seal trades. The Apprenticeship Completion Grant (ACG) is a one-time taxable cash grant of $2,000 maximum available to registered apprentices who have successfully completed their apprenticeship training and obtained their journeyperson certification in a designated Red Seal trade on or after January 1, 2009.

For more information on either of these incentive visit www.servicecanada.gc.ca

Loans for Tools

The Loans for Tools program offers new apprentices a loan to help them buy the tools and equipment they need to perform the trade in which they are registered. The loans for tools is available to newly registered apprentices.

For more information

Contact: Ontario Ministry of Training, Colleges and Universities Loans for Tools Program Toll-free 1-800-313-1746. The Canada Apprentice Loan is an initiative of the Government of Canada to help you complete your apprenticeship in a designated Red Seal trade. Starting in January 2015, you can apply for up to $4,000 in interest-free loans per period of technical training. The money will be available to you to help pay for tuition, tools, equipment and living expenses, to cover forgone wages or to help support your family.

For more information, visit link.

Employer Incentives

Apprenticeship Training Tax Credit

In the 2015 Ontario Budget, the government announced several changes to the Apprenticeship Training Tax Credit. The proposed changes were enacted through Bill 91, Building Ontario Up Act (Budget Measures), 2015 which received Royal Assent on June 4, 2015. The apprenticeship training tax credit is a refundable tax credit. It is available to employers who hire and train apprentices in certain skilled trades during the first 36 months of an apprenticeship program that commenced on or after April 24, 2015.

For apprenticeship programs that commenced before April 24, 2015, for eligible expenditures incurred after March 26, 2009, the first 48 months of the apprenticeship program qualify for purposes of the tax credit. The tax credit is based on salaries and wages paid to an apprentice. Qualifying businesses can claim 25 per cent of eligible expenditures (30 per cent for small businesses) made during the first 36 months of an apprenticeship program that commenced on or after April 24, 2015. The maximum credit for each apprenticeship is $5,000 per year. The maximum credit over the first 36‑month period of the apprenticeship is $15,000.

For more information, please visit www.fin.gov.on.ca/en/credit/attc

Choose a course that interests you

Fill out our online application

LiUNA Local 183 Training Centre will contact you if space is available in your selected program

If selected, begin your education with LiUNA Local 183 Training Centre

Program Requirements

- Be at least 18 years old

- Have a valid Ontario driver’s licence (G or G2)

- Having work experience in the construction sector is an asset

- Members receive priority for all training

- Have completed their grade 10 education (transcripts required)

- Have a valid Social Insurance Number

- Have a provincially accepted piece of identification with date of birth on it

- Completed a pre-screening aptitude test and achieved a mark of at least 70%

Beneficial Attributes

- Eager to develop new skills

- Show initiative

- Willingness to work outdoors and/or perform physically demanding work

- Excellent communication and listening skills to interact with peers and instructors

- Able to work as part of a team and/or independently

- Strong work ethic and positive attitude

- Organized, punctual and reliable